California Bottle Bill

What Washington Wineries Need to Know

Last year California added wine and spirits bottles to California's beverage container recycling program. Starting January 1, 2024, every Washington winery that ships wine to California needs to register with California's CalRecycle, file monthly reports, and pay processing fees on wine sold to their state. Also, starting July 1, 2025, wine bottle labels for wine sold in California will be required to include CRV, or California Redemption Value. The Washington Wine Institute invited our Association legal team of expert alcohol attorneys from Foster Garvey PC Emily Gant and Adena Santiago to detail the recent changes, products subject to the new requirements, the required markings and labels, how to register for the program, and more in a webinar.

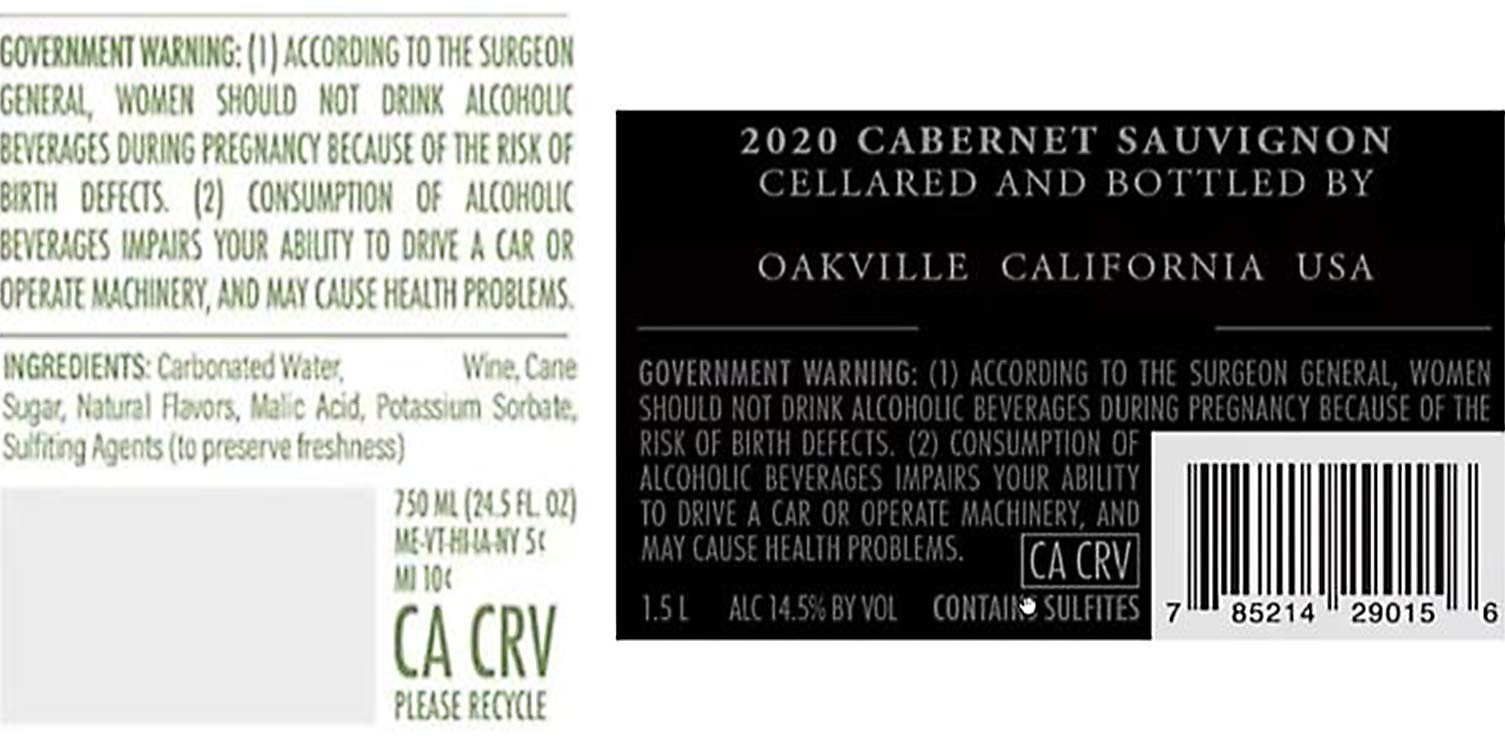

Show us your labels!

WWI is compiling a database of real wine labels CalRecycle has accepted as well as labels that were not accepted in the California Beverage Container Recycling Program. We ask that you send your labels to marie@wwi.wine and please indicate whether or not they were accepted.

Approved Label Examples

FAQs

-

What are the different processing fees?

Applicable containers include metal, glass, or plastic

- Containers under 24 oz: $.05

- Containers 24 oz or more: $.10

- Boxes, bladders or pouches: $.25

- Administrative fee: 1.5%

-

Do I need to report wine that was sold after January 1, 2024 to be shipped to California, but was bottled and labeled prior to January 1, 2024?

Yes. A sale that is made after January 1, 2024 needs to be reported. Anything shipped into California to a consumer after January 1, 2024 needs to be reported and fees are required, regardless of if the labeling and bottling happened before or after the date. The first reports are due in March for beverage manufacturers. The new labeling requirement is optional until July 1, 2025, when it will be a requirement for wine shipped to California.

-

If my wine is bottled and labeled before 2024, am I exempt from registration?

No.

-

Do reports need to be filed the month/2nd month following the sale or following the physical shipment into California?

CalRecycle is requiring reporting when the sale is being made to the consumer in the state of California. It is our understanding that reporting is based on the sale, when the money is tendered for the product, even if the product isn’t shipped until days later.

-

Do we as a Direct-to-consumer (DTC) shipper have to pay 10 cents per bottle as a beverage manufacturer and 10 cents again as a beverage distributor?

Yes. At this time, you are required to register as both a manufacturer and distributor and report your volumes for both and pay the fees generated as a result of that.

-

Do I need to report the sales of wine that is shipped to a warehouse in California on its way to another state? Is there a difference between warehouses to be sold versus resold on its way to a different state?

If you’re making sales to a distributor in California or a warehouse and it’s not being consumed in California, then there is not a situation in which this impacts recycling in the state. Sales that do need to be reported would primarily be sales of wine going directly to the consumer under your DTC permit.

-

Do I need to report the sales of wine that is shipped to a warehouse in California on its way to another state? Is there a difference between warehouses to be sold versus resold on its way to a different state?

If you’re making sales to a distributor in California or a warehouse and it’s not being consumed in California, then there is not a situation in which this impacts recycling in the state. Sales that do need to be reported would primarily be sales of wine going directly to the consumer under your DTC permit.

The purpose of the bottle bill is to promote recycling. Money is collected so different resources can be provided in California, so if the product isn’t being emptied, consumed and returned in the state, then those types of sales would not be included in reporting and fees. There are other requirements further down the line, but you as the beverage manufacturer wouldn’t be considered a beverage manufacturer or distributor for these purposes. Under the definition of manufacturer vs. distributor, reporting and fees under this bill primarily pertain to you if you hold that California ABC DTC shipping permit.

-

When would partial payments and other payments later be reported?

This situation is not applicable as these requirements do not pertain to sales to a distributor in California, but rather to a consumer that orders wine to be sent to them. For example, the consumer places the order and the product is shipped to them under your DTC permit. The sale gets accounted for when the money is transacted.

Please note that sales shipped to a distributor would not be included in reporting and fees as you do not need a shipping permit to ship to a distributor in California. Sales that need to be reported would primarily be sales of wine going directly to the consumer under your DTC permit.

-

Is it possible to affix a separate CA CRV label to the bottles being shipped to California (i.e. stickers)?

When the labeling comes into effect July 1, 2025 a sticker is sufficient (as long as it is not going on a canned beverage), but CalRecycle may at a later time require a more permanent label. There are changes you can make to a COLA without needing to get a new COLA. Redemption language is a change you could make to your TTB-approved COLA. You could also use a sticker after July 1, 2025, as long as it meets the requirements.

The message may appear on the primary label display or the secondary label display. As long as it is on a glass bottle and is a printed statement that cannot be wiped off, the placement is not a concern.

-

Can we create a sticker with the required information AFTER July 2025 and use that as part of the labeling requirement?

Yes, a separate sticker with "CA CRV" in the proper type size would be acceptable at least initially. We believe CalRecycle will continue to allow this but this is so new that processes and requirements are still developing. As we mentioned on the webinar, we would highly recommend that members submit their proposed labels for review by CalRecycle since the requirements are so specific.

-

Does wine bottled after January 1, 2024 have to have the California Redemption Value (CRV) verbiage or just bottled wine sold after July 2025?

The CRV language on the label is optional until July 1, 2025. Anything bottled and labeled before January 1st 2024 cannot have the CRV message on the label. From January 2024 to July 2025 the CRV message is optional, and this period gives wineries some time to work on the new labeling requirement. The labeling requirement is only mandatory starting July 2025.

-

What if the amount is on the label (i.e. CA CRV 10 cents)?

A label with the CRV amount is technically a noncompliant label. According to the California Bottle Bill, you are subject to civil penalties if your materials don’t comply. It is possible that your DTC shipper permit could get pulled by the California Alcoholic Beverage Control (ABC).

-

If we sold the wine in 2023 but we are not shipping it until 2024, do we need to report those sales?

No.

-

Is sales tax to be paid on the CRV?

Yes. If you’re shipping wine directly to a consumer in California and you’re collecting sales tax on the total purchase price, then the total purchase price does need to include the CRV (i.e. the extra 5 cents, the extra 10 cents).

-

How long does it take CalRecycle to process registration? I submitted my registration months ago but have not received a CalRecycle permit number?

There isn’t an exact estimation of how long registration processing will take for CalRecycle. In an email to a Washington Wine Institute member, CalRecycle states: “We are in receipt and want to thank you for your patience and understanding in advance. Nothing more is required on your part at this time. Your registration form is currently in an extensive queue for assignment to a Registration Unit analyst. After assignment has occurred, [Winery Name] will be under review, and you will be notified at that time via email or phone call if any additional information is needed for completion.

In the event that we are not able to fully complete your registration prior to January 1, 2024, your account will be retroactive to report processing fees and/or CRV for sales that began January 1, 2024. You will not incur any penalties in this instance; however, once registered you will work closely with your newly assigned Account Representative to bring your account current once you have been granted access to the online reporting portal. In the meantime, set aside any CRV fees collected for sales of your beverages beginning January 1, 2024 for future reporting/payment to CalRecycle...”

- Some important deadlines to note for any January sales:

- Reporting is due March 10th for Manufacturers

- Reporting is due at the end of February for Distributors

Beverage Manufacturer and Distributor

2024 REPORTING & PAYMENT CALENDARJanuary 2024 BM November 2023 sales due January 10

DS December 2023 sales due January 31

February 2024 BM & DS 2023 Annual Reports due February 1

BM December 2023 sales due February 10

DS January 2024 sales due February 29

March 2024 BM January 2024 sales due March 10

DS February 2024 sales due March 31

April 2024 BM February 2024 2024 sales due

April 10 DS March 2024 sales due April 30

May 2024 BM March 2024 sales due May 10

DS April 2024 sales due May 31

June 2024 BM April 2024 sales due June 10

DS May 2024 sales due June 30

July 2024 BM May 2024 sales due July 10

DS June 2024 sales due July 31

August 2024 BM June 2024 sales due August 10

DS July 2024 sales due August 31

September 2024 BM July 2024 sales due September 10

DS August 2024 sales due September 30

October 2024 BM August 2024 sales due October 10

DS September 2024 sales due October 31

November 2024 BM September 2024 sales due November 10

DS October 2024 sales due November 30

December 2024 BM October 2024 sales due December 10

DS November 2024 sales due December 31

January 2025 BM November 2024 sales due January 10

DS December 2024 sales due January 31

February 2025 BM & DS 2024 Annual Reports due February 1

BM December 2024 Sales due February 10

DS January 2025 sales due February 28

Note: If due date falls on a holiday or weekend, the due date will be moved to the next business day.Is there a way to file reports without an assigned identification number if CalRecycle has not contacted me with one after my registration?Those who do not yet have a registration number will be unable to access the portal to do any reporting and make any payments. As long as you have submitted your registration and have not heard back, CalRecycle will contact you with any updates and next steps.

From CalRecycle: “We can however offer a preview link to the Participant Management Units, Beverage Manufacturer and Distributor Reporting and Payment Manual to provide you with an overview of what the various screens within the Online Portal will look like. Future updates to include box, bladder or pouch container fields to the online reporting portal are in the works.”

Member Login

Member Login